Inspiring Ideas

“Innovation is the ability to see change as an opportunity - not a threat”

Thursday, March 21, 2019

I read this article this past weekend after all of the news about the college entrance bombs that were exposed over the last few weeks. While I think most people knew that the college admissions have always been biased, whether it was due to the policy of legacy admissions or those that provide large funds to schools, the fraud involved on these admissions scams even made me shake my head.

The more I look at the college entrance process, the more I start to wonder about the value. As my son gets ready to head to higher education, I have a new perspective on the decisions the students and parents have to make.

As a hiring manager, I also have seen a wide range of candidates come in from having ivy league and premier college undergrad and masters degrees, to those that have no college education but have the education of life.

This article speaks well to what will make an employee succeed, it's the skills stupid. The employees that have been successful are those that find ways around issues, don't let a bad day stop their drive, and an enterprising spirit that always pushes them to learn more and always improve.

What if we moved to a mentorship and internship model, where employers helped their employees become students that can supplement the skills they learn on the job with nano-degrees that increase their expertise. How can we optimize the natural skills and strengths a student has and supplement them with the courses that will accelerate their performance? In the world of fail fast and agile everything, why not try a new model of education?

Friday, October 7, 2011

Food Journey–Week 1

So I’ve been working on improving my diet for about a week now, and the results are better than I thought. I was sick most of last week, but started Susan’s plan this past Sunday after I recovered. Susan’s nutritional guidance has me drinking a complete nutrition shake for breakfast, followed by a meal about every 3 hours. Overall, the meals have more protein than I used to eat, and they are much more balanced with less sugars and processed products.

The first few days were a bit hard, felt as I was eating too much. But the last two days have been better, and actually, I find that eating more often makes my body hungry on a new schedule. But the hunger is not ravenous, its more controlled. I also noticed that I don’t have as many cravings. I was really bad about eating candy on the way home or eating cereal as a night snack. Those cravings have reduced quite a bit.

I’ve also started running again (about 3-4 miles a day). Susan is adjusting the diet to help bring up my energy level for my runs. So the diet will change a bit more over the next few weeks. My first race is on the 14th so only 7 days away. Not expecting a PR but want to run a strong race. The fuel on the days leading up to the race will be interesting.

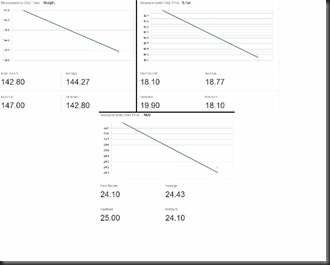

Overall, I’m impressed with how quickly the changes have gone into effect. The chart above shows about a 4 pound drop in weight, about a 1% body fat drop, and about 1 point of on my BMI. I think that is not normal but impressive.

Thursday, April 23, 2009

The cost of our investment in GM and Chrysler

http://blogs.wsj.com/deals/2009/04/23/mean-street-chrysler-crisis-you-lose-taxpayers/

The sad part is that we had to see this coming. Investing billions of dollars of U.S. Taxpayer money into the auto industry looked like a questionable deal. I felt that investing in GM had a potential benefit of saving a large number of jobs (both at GM and all of the suppliers, dealers, etc that feed off GM) and thereby, keeping the U.S. economy a float. But the more that we see, the reality is that the whole auto industry is in a slump, and bad management in this type of environment is going to kill, not just slow an industry down.

Chrysler is essentially bankrupt, I don't know what their cash position is these days, but who is going to buy a vehicle from them now. GM still has some strong brands but there is no way that they are going to remain the number 1 car company in the world. They are going to have to shed huge assets at a steep discount, and the taxpayer is going to foot that bill.

We'll see what Fiat does with these two negotiations, it feels like they are in a position to benefit from the government intervention by low balling these failing companies and getting assets on the cheap, maybe we should have given them the money...

Wednesday, April 1, 2009

House tries to limit executive compensation - Apr. 1, 2009

I'm not really sure what to think about this latest piece of legislation. The taxpayer has expressed outrage over the AIG compensation, there is tremendous frustration at how the bail out money is being spent by the banks, and there is a huge sense of nervousness walking into the auto industry bailouts. There is more pressure on the politicians to "govern" businesses then I have ever seen in my lifetime.

Should taxpayer ire determine what the right legislation and the right governance is around those that receive the stimulus and bail out money?

I definitely think that those that abused or skirted laws meant to protect this nation should be penalized for their behavior. Markets can't determine what is morally ethical, they can only determine the right prices and through the Darwinsim process that is capitalism, weed out those that are too weak to survive in cut throat competition. It is the government's role to ensure that businesses do not profit at the expense of the greater good.

Example: if a business were built on sending children into mines that were not fit for adults to enter, and that business made tremendous profits of that labor force without regards to risk and/or proper compensation, that should be regulated. I don't think anyone would argue against this.

Where the water gets murky is the situation we are in today. Things are rarely black and white.

Today, the government is trying to do the right thing. The companies that are being bailed out do not deserve to have inflated incomes; they could not survive on their own. They took on too much risk, or they made very shoddy business decisions, and now, they are failing.

In an unfortunate scenario for the tax payer, these companies are “too big to fail" and the assessment of the experts is that if there were no intervention, the world economy would suffer beyond what we are seeing today. The only recourse was to invest or loan or grant enormous amounts of funds to these organizations in order to protect us, the taxpayers. But at that point, what is done with that money becomes the problem, and there are not any easy answers.

In a normal situation, a VC, a bond holder, or a bank would provide capital and elect a board to manage their investment. That board would need to hold the shareholders and the bond holders’ interests in mind when big decisions are being made. BUT, the key is that they know their role. A wise board may not get involved in the day to day administration of a company if they do not have a strong understanding or expertise in the core functions of the company. They will hire the right CEO, the right executives, who in turn will hire their teams to try to maximize the company’s profits. They will try to incentivize those employees through multiple channels, compensation, opportunities, benefits, perks, community, etc.

In the situation we have today, there were bad seeds that ruined the company’s chances to perform optimally, the business failed on of bad strategy, acceptance of inordinately high risks, and/or a combination of the two. Now, the government steps in to play to role of the VC, the bond holder, or the bank. They are putting their boards together, and then trying to determine what type of governance they need to hold those that are hired into, or remain at the company accountable.

The first reg that was proposed was a 90% tax on all non performance related bonuses; the second is to ban all bonuses that are not performance related.

The problem with all of this is that how do we know that these regs are going to ensure that the company is doing the right thing with the capital that has been infused? Do these regs ensure that the money will be managed in the best manner to ensure that the company does not fail? How do we ensure that these companies wisely manage their businesses when they did such a piss poor job of it the first time around?

I don't have a straight answer, but I am very leery of over regulating businesses. The market does one thing very well, it weeds out the weak. If there is any additional burden placed on a business that allows a competitor to take advantage of the situation, it will happen and failure is much more likely. That is how the system works. You can't legislate those companies that have not taken on government bailouts, if you do, you are essentially building a socialist system. I don't think that is what the U.S. needs.

I don't want bonuses to be paid out for those folks that made a mess out of these companies, but if there are employees much further down the food chain that got a bonus for moving their family from the east coast to the west coast, and might help the company get back on its feet, how do we know that bonus will be allowed, how do we know that this reg prevents the ability from attracting the right talent? Any change in compensation has an impact, you don't know how people will react to these type of situations.

I think there needs to be more discussions on how to manage this situation. We'll see what happens.

Saturday, March 28, 2009

Web 3.0 Conference: Profit and gain insight by organizing information with semantic web and linked data technologies, May 19-20, 2009 New York City

The great pontificators of the web are going to arrive in New York to discuss what's next. I think at a time when our economy is bottoming out and people are struggling to find answers, these type of conferences can really help the U.S. start to climb out of the rut. Don't get me wrong, thinking about the future and actually realizing the benefits are not the same thing, execution is definitely the key to success. But disruptive technologies and radical breakthroughs need to be top of the mind.

Many of you have probably heard of the semantic web, I like to think of it as artificial intelligence on the web. The key to a semantic web is intelligence. All of this data that we are putting out on google, facebook, twitter, blogs, email, SMS, smart phones is very meaningful. However, it is not meaningful when it is in silo.

What would happen if there was a way to connect all of these disparate systems? What if there was a means to help a system understand what all of the data you are putting out there means and then help you live your life?

I think the immediate fear is one of "Big Brother" or HAL 9000 from 2001: A Space Odyssey, and there is definitely a risk that if this data is not secured and that the right regulations are not in place, there could really be some danger associated with integrating all of this data. At the same time, think of the possibilities that could come from connecting your information?

Below is a vision presented by Microsoft, much of it is very UI focused and the way we interact with computer systems stands out, but take a look at something deeper. Your data can help you live your life, become a stronger employer, a better customer, retailer, teacher, ...

I'd love to see the day that I can jump in my car and see the top 5 things that I need to get done on the windshield. From there, quick access to help me get through those tasks while reminding me to get some exercise and to make sure that I call my kids to wish them good luck on their school presentation. Your data knows all of that about you, but today, you need to look for it, you have to make decisions, review the data, and plan your events. But on any given day, how different are those decisions, or those plans? We are creatures of habit, if your data can be mined and analyzed, very strong trends would stand out that could then be presented back to you to help you with your life.

Taking another leap, advertisers would actually be in a position to help you make the best purchases for your needs. It would be the ultimate sales scenario, your data can help present you with options that you really need, not spam that fires at you because you used a key search word that might mean that you want to buy something. If you just left to go on a trip to New York for a big presentation like the Web 3.0 conference, and your data knows that you like to eat Italian, prefer to take taxis over the train, and that you like staying at the Marriott, how about getting all of that setup for you by clicking one button on your phone?

I don't think we are that far away from this day, the key is, who will make this a possibility? Let’s push for the innovators to keep making the U.S. great. There are always opportunities to make life better for all of us.

Monday, March 23, 2009

Treasury Secretary Timothy Geithner Details His Toxic-Asset Strategy, the Public-Private Investment Program - WSJ.com

Here are some snippets from today's announcement of the Treasury's plan.

"Now all Mr. Geithner has to do is find private investors willing to "partner" with the feds (Congress!) to bid for those rotten assets, coax the banks to sell them at a loss, and hope that the economy doesn't keep falling lest taxpayers lose big on their new loan guarantees."

"Don't be fooled because Treasury isn't going to Capitol Hill for more cash. The Obama Administration is instead leveraging the balance sheets of the Federal Reserve and Federal Deposit Insurance Corp., which will lend to the new public-private entities to buy the toxic assets.

In the case of the FDIC, it will lend at a debt-to-equity ratio of 6-to-l to the buyers. This means, according to the Treasury example, that the FDIC would guarantee 72 cents in funding for an asset purchased for 84 cents on the dollar. The feds and private investors would each put up six cents in capital. If the asset rises in value over time, the taxpayer and investors share the upside. If it falls further, then the taxpayers would absorb by far the biggest chunk of the losses. Better hope the recovery really is, as the White House says, just around the corner."

Doesn't leave you jumping for joy does it, but the market reacted in a tremendous way to this announcement (I'm sure some of the upside also had to do with the fact that the Feb housing numbers looked much better than expected).

I'm trying to absorb what type of bet Geithner is making and then handicap this bet by understanding the risks that we the taxpayers will be taking on.

I like this guy's explanation of what went south over the last ten years or so with the housing bubble and then the collapse over the last two years or so.

Now that we have an understanding of what kind of mess we are in, the Treasury is planning on helping those banks that are holding these toxic assets that may never get payment. So Geithner's plan does the following:

Under a typical transaction, for every $100 in soured mortgages being purchased from banks, the private sector would put up $7 and that would be matched by $7 from the government. The remaining $86 would be covered by a government loan. So we the tax payer's essentially loan the government and the private investor's money, not sure at what rate the loan is given, but its given at a 6:1 debt/capital ratio. This loan helps them purchase these bad assets off the banks for a given price. Right now, there is going to be some mechanism to determine the price of these assets. I think this is going to occur under the FDIC watch, and then fund managers will be elected to manage these funds to ensure that we are buying the assets at a good price with hopes of a strong return.

The pros I see:

1. By providing up to a Trillion dollars (how the heck did we start thinking that a trillion dollars can be thrown around so easily) to the banks, it should really start incentiving these banks to start lending and making money on their loans.

2. Then as the loans start to go out, people may start buying homes again pushing up demand for homes and pushing up prices.

3. Hopefully, the economy starts to pick up as people's confidence comes back and jobs start to increase with the other TARP programs and with more capital available in the market.

4. Then the private investors and the treasury start to make profits in their investments into these toxic assets and the FDIC starts to get their loan back so the US Taxpayer gets money back with their profits and whatever the loan rate was.

The risks I see are:

1. We don't know what the banks are going to sell, with AIG, I think all private industries are very wary of working with the government because then the public essentially can react in a very negative way if anything looks unpleasant. Let's say that the housing market turns around, the bad assets all of the sudden become very strong house values and these private investors start making billions of dollars off the tax payer's money. Should they keep all of these huge gains or give some back?

2. How are the prices of these assets going to be determined, its not like there are thousands of people trying to gauge the risk of these assets, the FDIC will be doing that analysis, and its not a free market, so there seems to be a lot of unknowns around how much money the bad assets are going to be need to be purchased for. If the price is too high, then any failure puts the tax payer money at a huge risk, if its too low, then the banks are not going to take them off their balance sheets and try to wait out the storm in hopes that the underlying assets will return to higher prices.

3. Will the economy turn around anytime soon. What happens if all of this doesn't work and the economy turns south, the job losses continue, the house values continue to drop, and investments from foreign entities dry up? Then the U.S treasury has no money and the underlying assets that were invested into are worthless. Its back to the printing press and China is really starting to put some strong pressure saying that they are not very happy with their investments being put at risk with all of this mess.

At this point, I don't know what alternatives there are out there, let's hope that we have bottomed out and the economy starts to really pick up with these banks starting to lend money again. Its time for the innovators to come out and start building strong businesses that will hire more US employees, and start reving up the engine again.

Friday, March 20, 2009

Citigroup CEO protests efforts to tax bonuses - International Business - Business - The Times of India

I agree, I don't want to see our tax payer money given to the rich as much as the next guy, but the reality is, if you want to invest in getting these companies back around, I'd rather invest in top talent, then force these companies to work with less than the best.It would be similar to you taking over a basketball team who was caught cheating, you fire the coach who cheated, but then you decide that you are going to cut all the player's salary, and one of your player's is named Jordan. if Jordan walks, there goes any chance of you being successful.